- Ziggurat Realestatecorp

- Nov 3

- 4 min read

Upgrades provide natural conversations, cameras that find lost dogs

A decade ago, Amazon’s Echo and Google’s Home offered us a taste of the future: We speak, and our homes respond. But when ChatGPT and other AI chatbots arrived, those “smart” speakers started to feel pretty basic.

Now that they’re getting a generative- AI overhaul, the question is: Can we get more out of devices that until now have been great at setting kitchen timers, reading the weather and playing music?

Most homes are “smart”: Consumer- tech tracking firm Parks Associates reports just over half of internet-connected U.S. households own at least one smart speaker. Yet smart-home adoption has stalled since peaking in 2021, says research firm IDC. Anyone who has wrestled with a smart light, thermostat or other home tech knows the pain. A multitude of fussy apps and the need to memorize countless verbal commands were a big part of the problem.

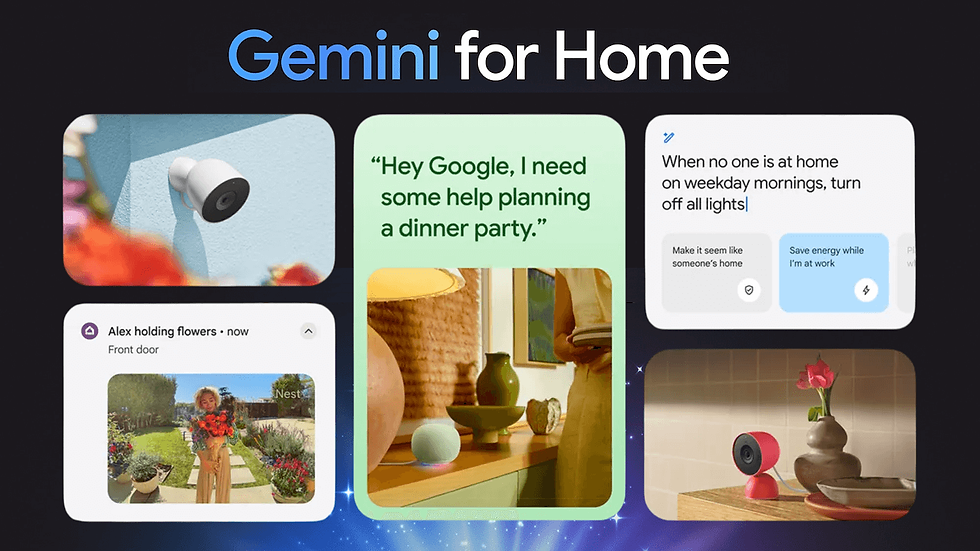

Amazon’s Alexa+ and Google’s Gemini aim to fix that, by making smart homes less dumb. The tech giants introduced new speakers, home displays and cameras this week to capitalize on their evolved assistants, but most existing devices are also compatible.

Gemini for Home arrives at the end of the month, and Amazon says 10 million households have early access to Alexa+. As we wait for Apple’s Siri to catch up, here are the three big changes coming to our homes right now.

Cameras that tell you what’s happening

When you get a security camera alert, you tend to open an app and peer in wondering at what might be lurking in or outside your house.

With Gemini for Home—which you can gain early access now in the Google Home app—Nest cam notifications have more useful descriptions, such as “Dog jumped out of playpen,” or “USPS dropped a package off on your porch.”

Inside the app, you can ask queries like, “When did the gardener arrive last week?” to pull up relevant clips. In a demo, “What ate my grass?” showed rabbits munching in the garden. The cameras can also summarize daily highlights such as kid activity or package delivery. Amazon’s Ring announced similar features called Video Descriptions and Smart Video Search earlier this year— available to Home Premium plans.

In December, Ring will add Familiar Faces, allowing its doorbells and other cameras to recognize people you know. The system matches faces based on your videos only, and the identification is stored with your account. Also coming in December is a service that allows Alexa+ to greet people at the door, whether they’re familiar or unfamiliar faces. Ring is attempting a more ambitious task as well: finding lost dogs.

You can trigger a “Search Party” by providing details and a photo of your missing dog. Any outdoor Ring cameras in the vicinity that spot your dog will alert those camera owners.

If they want to notify you, they can with a tap. (They can also choose to ignore the alert, and even disable Search Party entirely.) Search Party, available in November, is only for dogs at launch, but Amazon is looking beyond canines. In addition to evaluating algorithms for other pets—hello, cats!—it is considering monitoring for lost people as well.

“There are thousands of people missing with dementia all the time, so you can imagine looking for them,” says Jamie Siminoff, who founded Ring and currently heads the Amazon subsidiary.

Siminoff noted the privacy concerns, and emphasized that videos will never be shared without the consent of the camera users. In addition, Ring says it doesn’t use private customer videos to train its AI models.

Speakers that have real conversations

As soon as you upgrade to Alexa+ or Gemini for Home, the biggest change you’ll notice is the humanness of the assistant. Conversations flow freely; you don’t need to repeat the wake word. We’ve asked Alexa+ about classical architecture, amenities at a campground, whether selenium is water-soluble and more, with informative responses.

We have yet to stump it. Responses to conventional smart-speaker requests are improving, too. When Gemini for Home rolls out, you can say, “Set a timer for roasted carrots”—Gemini will ask appropriate follow-ups and start a countdown. You can also ask: “Play a recent podcast featuring Serena Williams” or “My dishwasher isn’t draining.

What should I check first?” Like ChatGPT, these AI-powered assistants sometimes hallucinate, too. Alexa+ offered to make a restaurant reservation via Open- Table. The restaurant wasn’t even on the app yet it insisted we had a booking. Hey, that’s why it’s still early access.

Automation without the app headache

The magic of the smart home is when stuff happens exactly when you need it to. Previously, this felt like it required a computer-engineering degree. Now, you can create these automations just by describing what you want. Seriously.

For example, asking Gemini to “make me feel safer” will check that the doors are locked, windows closed and—if you’re not home— lights are toggling on and off. Amazon’s devices chief, Panos Panay, shared how his wife’s frustration with their son—“He just leaves the lights on!”—led her to ask Alexa to turn off lights each night at a given time. She didn’t realize she had created a routine, he says. Amazon’s new devices are equipped with more sensors to understand what’s happening in your home.

In other features rolling out in the coming months, they’ll learn habits—who’s home during the day, what doors should be locked after 10 p.m.—and will be able to adjust routines and alerts based on those patterns, the company says. (Alexa+ will come with all the new Echo devices.) We’ll be doing more testing with Alexa+, Gemini for Home and the new devices.

But these smart assistants already feel less like high-maintenance houseguests and more like family: They listen, learn and might even help find the missing dog.

Source: Wall Street Journal