- Ziggurat Realestatecorp

- Aug 1, 2025

- 1 min read

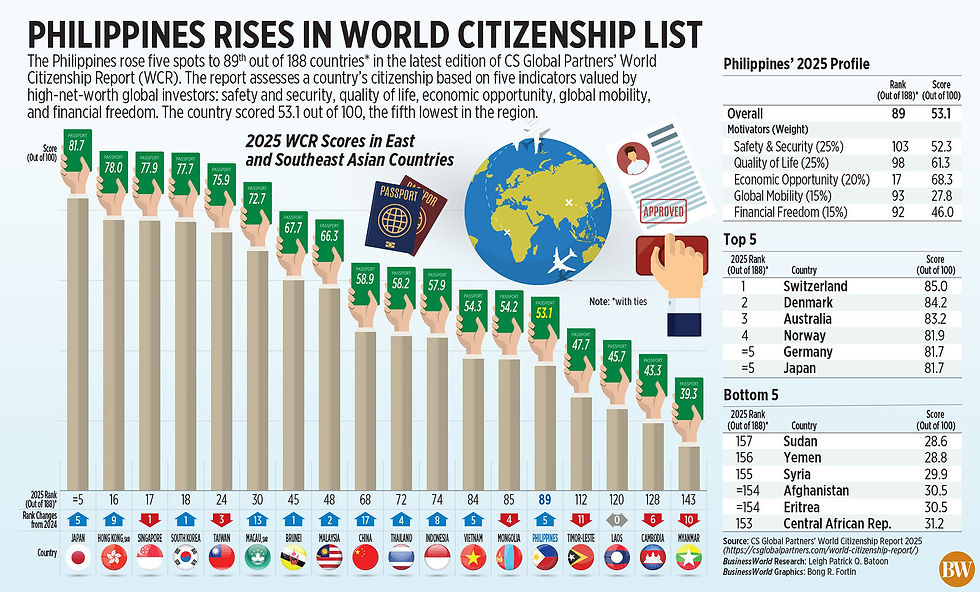

The Philippines rose five spots to 89th out of 188 countries in the latest edition of CS Global Partners’ World Citizenship Report (WCR). The report assesses a country’s citizenship based on five indicators valued by high-net-worth global investors: safety and security, quality of life, economic opportunity, global mobility, and financial freedom. The country scored 53.1 out of 100, the fifth lowest in the region.

Source: Business World