- Ziggurat Realestatecorp

- Oct 26, 2025

- 3 min read

Economy now seen expanding by just 5.2% next year

Philippine economic growth will continue to lose momentum next year as both household spending and investments cool, a Fitch Group unit said.

“Headwinds to growth are mounting,” BMI Country Risk & Industry Research said as it cut the 2026 growth forecast for the country to 5.2 percent from 6.2 percent.

That for 2025 was kept at 5.4 percent — lower than the 2024 result of 5.7 percent — and growth is also expected to slow in the last six months of the year.

Both forecasts fall below the government’s 5.5- to 6.5-percent target for this year and 6.0-7.5 percent for 2026. If realized, growth will have fallen below target for four straight years.

“Growth in H1 2025 was driven by front-loading activity and robust domestic consumption. However, we expect growth to slow in H2 2025,” BMI said in an Oct. 22 commentary.

“Investment is likely to stay subdued in H2 given the uncertain global environment and weak infrastructure spending.”

An ongoing corruption scandal was said to have worsened investor sentiment, with BMI noting that the Philippine Stock Exchange index had fallen to a near six-month low last Sept. 30.

Manufacturing activity has also shown signs of strain, with the purchasing managers’ index contracting for the first time in six months in September.

Exports, meanwhile, sharply slowed in August from a month earlier.

‘Outsized impact’

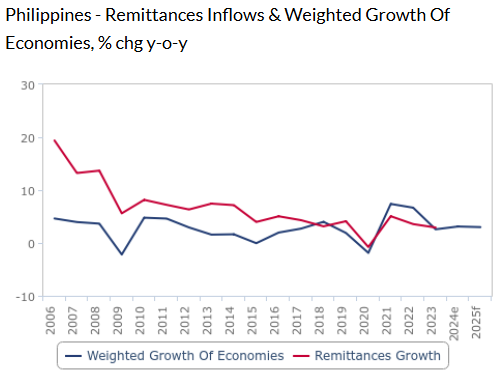

As for 2026, BMI said that remittance growth was likely to slow due to tighter United States immigration policy and a 1-percent tax.

“A slowdown in remittances will weigh on domestic consumption, which will have an outsized impact on growth given the domestically driven economy,” it said.

The trade balance also expected to worsen given a US-Philippines deal that imposed a 19-percent duty on Philippine exports and none on American goods.

Erratic US trade policies and global uncertainty, BMI added, are seen constraining foreign direct investment flows into the country.

The Fitch unit cautioned that the risks to its forecast were tilted to the downside.

“Should the ongoing probe uncover corruption across other infrastructure projects beyond flood control, it could lead to even tighter scrutiny on government spending and reduce spending substantially below fiscally programmed levels,” it said.

The economy has underperformed so far for the year, averaging just below the 5.5- to 6.5-percent target as of end-June following 5.4-percent and 5.5-percent results in the first two quarters.

Preliminary third-quarter growth data will be released on Nov. 7, and economic managers have warned of a slowdown due to government spending having slowed due to the corruption mess.

BMI expects growth to rebound to 6.2 percent in 2027 and 6.3 percent in 2028.

Deficit to narrow

The Fitch unit, in a separate Oct. 22 commentary, also said that the country was likely to post a narrower fiscal deficit with spending having fallen below target.

BMI said the shortfall was likely to hit 5.5 percent of gross domestic product this year, down from 5.7 percent in 2024, and ease further to 5.4 percent next year.

While revenue collections have exceeded average monthly targets since the start of the year up to August, spending over the same period was behind programmed levels due to an election ban and weak infrastructure disbursements.

The spending shortfall will likely narrow but still undershoot the 2025 budget, BMI said, noting that Budget Secretary Amenah Pangandaman has warned of a slowdown due to the corruption mess.

Government infrastructure spending slowed by 5.6 percent to P798.4 billion as of end-August from P845.3 billion recorded last year, Budget department data showed.

Budget officials said the infrastructure project implementation will likely accelerate in the fourth quarter with the typhoon season over, and ”payment of progress billings may also start to normalize in the latter part of the year as internal controls have been put in place” by the Public Works department.

Fiscal consolidation will remain slow next year, BMI said, with tax collections unlikely to keep up with next year’s proposed P6.79-trillion government budget.

Tariff collections are also expected to fall due to the trade deal with the US.

‘Fiscally unfeasible’

Next year’s fiscal deficit forecast, BMI said, is supported by a “one-off privatization” — equivalent to 0.3 percent of gross domestic product — planned by the government.

“We think that this is fiscally unfeasible over the long run,” it said.

BMI noted that the Philippines’ public finances remain fragile with the debt-to-GDP (gross domestic product) ratio hovering around 60 percent, significantly above the pre-pandemic level of 40 percent.

“Elevated borrowing costs and a narrow revenue base further limit Manila’s ability to deliver large-scale fiscal support without compromising debt sustainability,” it added.

Debt-to-GDP ratio as of end-June, meanwhile, had climbed to 63.1 percent from 62 percent in the previous quarter and 60.9 percent a year earlier. It also exceeded the 60-percent threshold that multilateral lenders consider manageable for developing economies.

Source: Manila Times