- Ziggurat Realestatecorp

- Aug 25

- 4 min read

Philippine economic growth may pick up in the third quarter despite higher US tariffs and “milder” typhoons, the University of Asia and the Pacific (UA&P) said.

“Despite the Trump tariffs, milder typhoon season will help accelerate GDP expansion in Q3 to 5.8%, given a low base in 2024,” it said in its latest The Market Call released on Friday.

If realized, this would be faster than 5.2% in the third quarter of 2024 and 5.5% print in the second quarter. This forecast is also within the government’s revised 5.5% to 6.5% target this year.

“Consumer spending remains strong, aided by low inflation but limited by new US taxes on OFW (overseas Filipino Worker) remittances,” UA&P said.

Inflation cooled to a near six-year low of 0.9% in July as utilities and food costs continued to ease. This brought the seven-month average to 1.7%, slightly below the Bangko Sentral ng Pilipinas’ (BSP) 2-4% target band.

UA&P said government infrastructure spending may also regain momentum in the third quarter. This was after state spending slumped due to the 45-day election ban on public works spending from March 28 to May 12.

UA&P said residential construction will remain subdued due to elevated policy and interest rates.

The Bangko Sentral ng Pilipinas (BSP) has so far lowered borrowing costs by a total of 125 basis points (bps) since it began its easing cycle in August last year. The policy rate now stands at 5.25%.

UA&P said the US dollar rate will “move either way” depending on rate cuts by the BSP and the US Federal Reserve.

“The peso-dollar rate has a fundamental depreciation bias although it will depend much on extent and timing of policy rate cuts by BSP and the Fed,” it said.

Meanwhile, UA&P said the outlook for the local bond market is better in the second semester.

“The local bond market heads towards a brighter second half with the deceleration of inflation, the National Government having raised all but less than 6% of its planned borrowing needs for 2025 and BSP planning 50 bps rate cuts between now and end-2025,” it said.

TARIFF-INDUCED SLOWDOWN

Meanwhile, ANZ Research said the Philippines may face more external pressures in the coming months, arising from US tariffs and a slowdown in the global economy.

In a report, ANZ said the Philippines’ services surplus has been moderating in recent quarters, as business process outsourcing and information technology exports remain resilient.

The services surplus narrowed to $3.3 billion in the first quarter from $4.2 billion in the fourth quarter.

“However, the IT-BPO (information technology-business process outsourcing) sector faces several risks in the near term. A tariff-induced slowdown in the global economy could dampen demand for outsourced services, particularly from the US, which is the largest consumer of Philippine IT-BPO exports,” ANZ said.

“If demand from US slows down, it could materially affect the Philippines’ services revenue.”

The IT-BPO sector is also dealing with the increasing adoption of artificial intelligence, as low-skilled workers are seen to be most vulnerable to displacement.

ANZ said the Philippines’ external accounts will face more challenges as goods exports demand is expected to weaken over the next few months.

“Though the Philippines’ exposure to US demand is relatively low, the wider impact of US tariffs on the global economy will affect its exports,” it said.

The US began imposing a 19% tariff on many goods from the Philippines on Aug. 7.

“Import demand stemming from private consumption is expected to remain subdued due to low wage growth, which is limiting purchasing power,” ANZ said.

ANZ said capital expenditure is likely to accelerate in the second half.

“Higher infrastructure spending typically translates to higher demand for capital imports for the Philippines, which will potentially further widen the trade deficit,” it said.

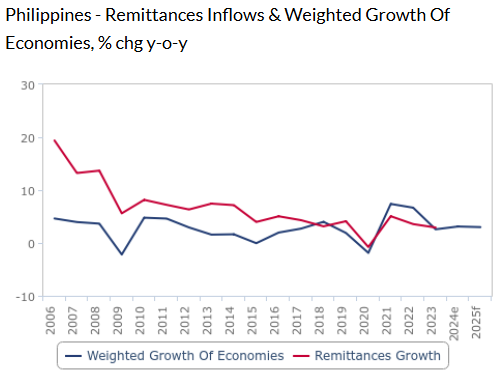

At the same time, ANZ said the 1% excise tax on remittances from the US is expected to have a “modest effect” on the country’s external accounts.

“This development is particularly relevant for the Philippines, given its heavy reliance on inward remittances from the US (about 40% of total remittances). It is also an important source of household income, consumption, and external account support. Remittances are a key component of the current account, helping offset the country’s persistent trade deficit,” it said.

The US will impose a 1% excise tax on cash-based remittances from the US to recipients abroad starting on Jan. 1, 2026. However, ANZ noted that since the new tax will be applied on cash-based remittances, its scope will be relatively limited.

“The Philippine Department of Finance estimates the total impact of the tax to be around $1.9 billion, which represents a small share of total remittances. As a result, while the effect on the Philippines’ external accounts is expected to be limited in 2026,” it said.

ANZ said a further slowdown in the US labor market will also affect the amount of remittances sent to the Philippines.

Money sent home by OFWs rose by 3.1% to $16.75 billion in the first six months of the year, with land-based workers contributing the bulk of the increase.

Source: Business World