- Ziggurat Realestatecorp

- 2 days ago

- 1 min read

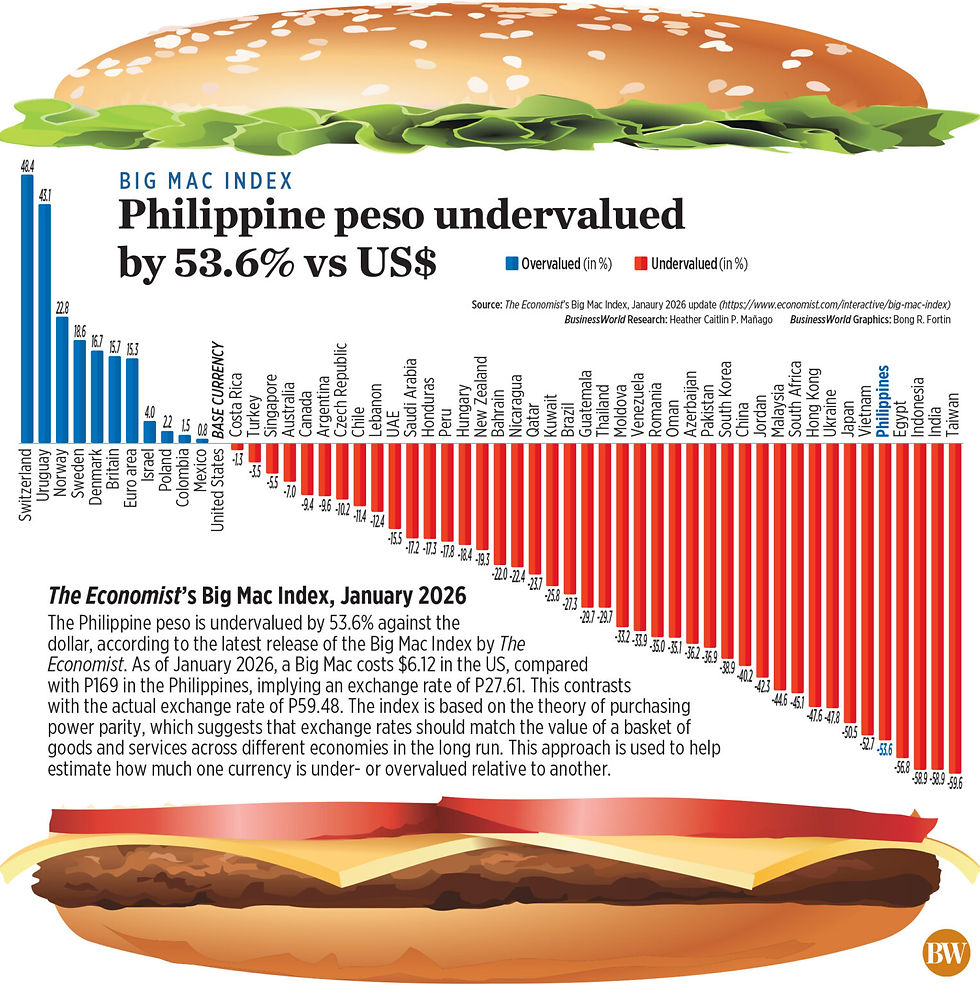

The Philippine peso is undervalued by 53.6% against the dollar, according to the latest release of the Big Mac Index by The Economist. As of January 2026, a Big Mac costs $6.12 in the US, compared with P169 in the Philippines, implying an exchange rate of P27.61.

This contrasts with the actual exchange rate of P59.48. The index is based on the theory of purchasing power parity, which suggests that exchange rates should match the value of a basket of goods and services across different economies in the long run.

This approach is used to help estimate how much one currency is under- or overvalued relative to another.

Source: Business World