- Ziggurat Realestatecorp

- Oct 3, 2024

- 2 min read

Home prices in the Philippines rose at a slower pace in the second quarter, as a high interest rate environment tempered demand for housing loans, the Bangko Sentral ng Pilipinas (BSP) reported.

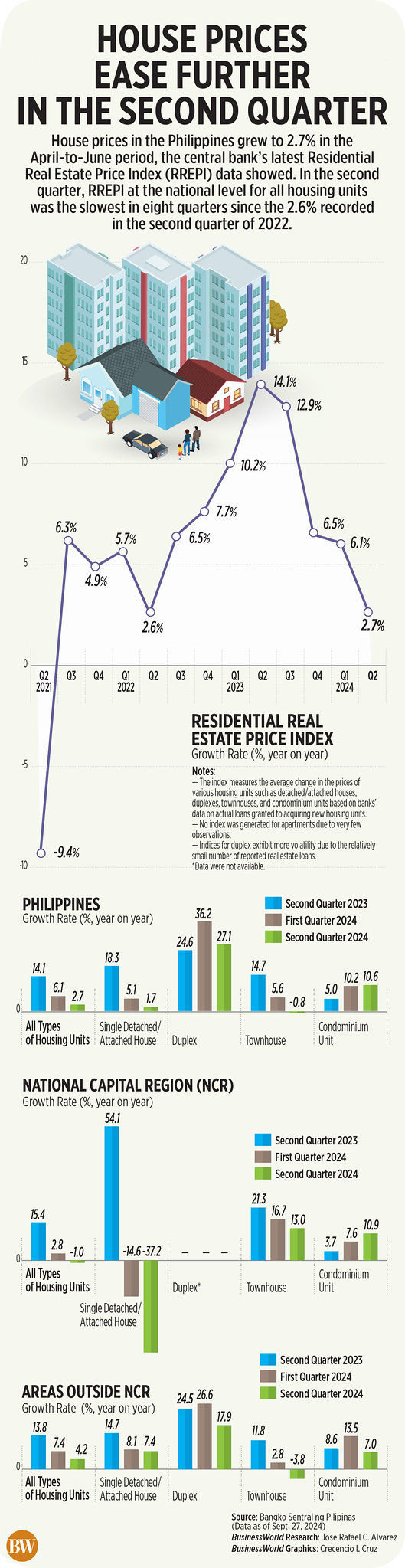

Nationwide costs of various types of new housing units—as measured by the residential real estate price index (RREPI)—went up by 2.7 percent year-on-year in the three months through June, easing from the 6.1 percent annualized increase recorded in the first quarter.

But on a quarter-on-quarter basis, home prices grew slightly faster at 1.8 percent than the 1.1-percent sequential jump recorded in the January-March period.

The RREPI is a measure of the average change in the prices of shelters based on banks’ data on actual mortgage loans granted to acquire new housing units. This quarterly gauge, however, excludes pre-owned or foreclosed properties.

By housing type, condominiums registered the highest year-on-year growth rate at 10.6 percent in the second quarter, followed by a 1.7-percent growth in single-detached/attached houses. Meanwhile, the cost of townhouses contracted by 0.8 percent.

BSP data showed the slower annual increase in prices of new shelters coincided with weak demand for home loans. In the second quarter, the number of housing loans granted by banks contracted by 3.5 percent year-on-year, a reversal from the 8.9-percent increase recorded in the preceding three months.

Quarter-on-quarter, home loans sagged by a bigger 15.1 percent, an indication that the economy continued to absorb the previous anti-inflation interest rate hikes of the BSP.

Easing cycle

Banks use the BSP’s policy rate as a guide when charging interest rates on loans. By making borrowing costs more expensive, the BSP wants to temper strong demand for commodities with limited supply. This, in effect, tames inflation.

But with inflation easing back to within the 2 to 4 percent target range of the central bank, the BSP in August kicked off its easing cycle with a quarter point cut to the policy rate, which is now at 6.25 percent. And Governor Eli Remolona Jr. earlier this week hinted at the possibility of two more reductions to the key rate at the last couple of meetings of the Monetary Board this year.

“The initial rate cut from the BSP and further cuts up to 2025 should result in lower mortgage rates and help resuscitate take up for residential units across the country,” said Joey Bondoc, senior research manager at Colliers Philippines.

Source: Inquirer and Business World