- Ziggurat Realestatecorp

- Aug 6, 2025

- 6 min read

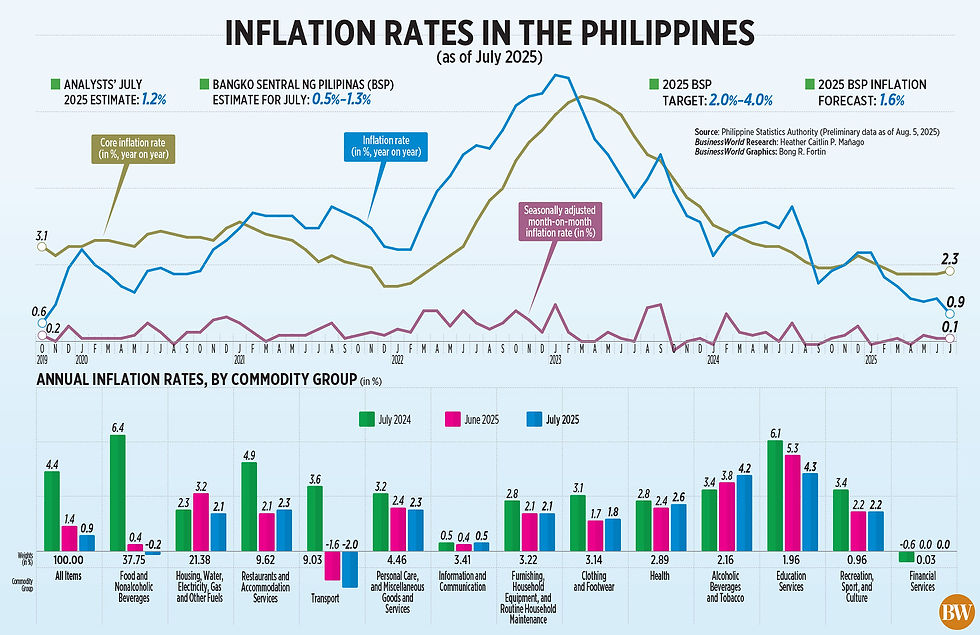

Headline inflation sharply slowed to a near six-year low in July as utilities and food costs continued to ease, data from the Philippine Statistics Authority (PSA) showed.

The PSA on Tuesday reported that the consumer price index rose 0.9% year on year in July, slower than the 1.4% in June and 4.4% clip a year ago.

This was the lowest inflation in nearly six years or since the 0.6% print posted in October 2019. It also marked the fifth straight month that inflation settled below the central bank’s 2-4% target range.

For the first seven months of the year, inflation averaged 1.7%, a tad higher than the BSP’s 1.6% full-year forecast.

Core inflation, which excludes volatile prices of food and fuel, inched up to 2.3% in July from 2.2% a month prior. In the January-to-July period, core inflation averaged 2.3%.

The BSP in a statement said that the July inflation outturn is well within its forecast.

“Inflation is projected to average below the lower end of the target in 2025, primarily due to the continued easing of rice prices,” it added.

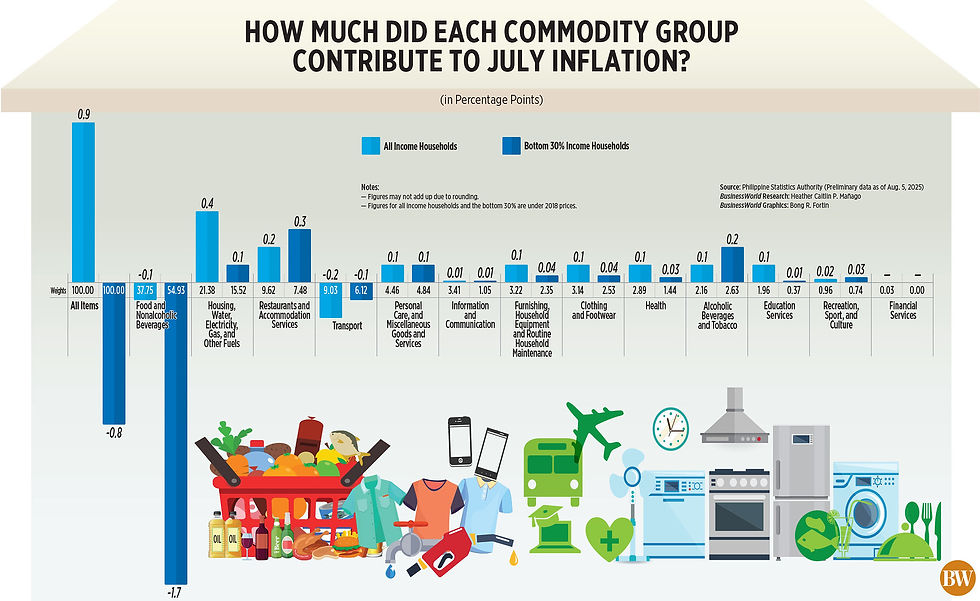

National Statistician Claire Dennis S. Mapa said the deceleration in July inflation was primarily due to the slower annual increase in the housing, water, electricity, gas and other fuels index.

The index eased to 2.1% in July from 3.2% in June, accounting for a 45.1% share to the overall downtrend in inflation.

This as electricity inflation decelerated to 1.3% in July from 7.4% a month ago, even as Manila Electric Co. (Meralco) hiked rates by P0.4883 per kilowatt-hour during the month.

Liquefied petroleum gas (LPG) also posted 0.7% inflation, slower than the 1.9% clip in June. In July, LPG providers Petron and Solane implemented a price rollback of P1 per kilogram each.

Meanwhile, the heavily weighted food and nonalcoholic beverages index also fell to 0.2% from the 0.4% increase in June.

Inflation of cereal and cereal products further contracted to 11.5% in July from the 10.3% decline a month earlier.

RICE PRICES

Rice inflation continued to remain in the negative, falling to a new all-time low of 15.9% since 1995.

“For the next four months, we will perhaps still be seeing negative inflation for rice. It’s a continuous decline in prices, even in our price per kilogram,” Mr. Mapa added.

The average price of regular milled rice fell by 18.2% to P41.31 per kilogram from P50.90 a year ago. Well-milled rice likewise declined by 14.8% year on year to P47.60 from P55.85, while special rice dropped by 11.8% to P56.83 from P64.42 per kilogram.

Since last year, the government has deployed several measures to tame prices of the staple grain, such as slashing tariffs on rice imports.

However, the Agriculture department this week recommended to President Ferdinand R. Marcos, Jr. a suspension of rice imports and increased tariffs amid declining farmgate prices.

In July 2024, rice tariffs were slashed to 15% from 35% amid spiraling prices at the time. Agriculture Secretary Francisco P. Tiu Laurel, Jr. earlier proposed a phased increase in rice import duties to the original 35%.

Mr. Mapa said the potential increase in tariffs could impact rice inflation moving forward.

“It depends on the timing… when there is an increase in the tariff, there is an implication that there will be an increase in the retail price,” he said, noting that they study how high the tariffs are and the timing of when these will be implemented.

Vegetables, tubers, plantains, cooking bananas and pulses saw a decline to 4.7% from the 2.8% drop in June.

Despite agriculture damage caused by recent weather disturbances, Mr. Mapa said vegetable inflation continued to ease.

“But we saw in the National Capital Region, particularly in the second half of July, there was an adjustment in the rise of certain vegetable items, such as leafy vegetables… We expect this month of August that there may be an upward adjustment in our prices of vegetables, and that may have an impact on our inflation rate,” Mr. Mapa said.

Meanwhile, the contraction in transport inflation worsened to 2% in July from the 1.6% decline in June. This as passenger transport by sea eased sharply to 5.2% from 24.8% the previous month.

Gasoline inflation also fell to 10% from the 8.9% contraction a month ago.

In July, pump price adjustments stood at a net decrease of P1.10 a liter for gasoline and P1.10 a liter for kerosene. On the other hand, it stood at a net increase of P1.20 for diesel.

Inflation within the National Capital Region (NCR) likewise eased to 1.7% in July from 2.6% in June.

Outside NCR, inflation slowed to 0.7% in July from 1.1% in June.

Inflation for the bottom 30% of income households slipped to 0.8% from the 0.4% dip in June. Year-to-date, inflation for the bottom 30% income households averaged 0.5%.

OUTLOOK

The central bank said headline inflation will likely settle within the 2-4% target band from this year until 2027.

“For 2026 and 2027, inflation is expected to trend higher but will remain firmly within the 2-4% target range,” it said.

“Global economic activity is showing signs of deceleration, influenced by uncertainty over US trade policy and ongoing geopolitical conflict in the Middle East. These developments may contribute to slower domestic growth.”

The BSP expects inflation to average 3.4% in 2026 and 3.3% in 2027.

Department of Economy, Planning, and Development (DEPDev) Secretary Arsenio M. Balisacan said overall inflation this year will “remain favorable and supportive of domestic demand.”

“The sustained drop in rice prices and the easing of inflation for low-income households are clear signs that our interventions are working,” he said in a statement.

“This not only helps Filipinos preserve the value of their peso but also builds confidence for businesses and consumers to plan ahead.”

DEPDev also cited data from the Philippine Atmospheric, Geophysical, and Astronomical Services Administration which showed a “relatively favorable climate outlook” from this month until January 2026.

“Nine to 17 tropical cyclones are expected, but the prevailing ENSO (El Niño-Southern Oscillation) neutral condition is likely to support stable agricultural production.”

However, Mr. Balisacan noted the need to “remain vigilant against external risks, including global policy shifts and geopolitical tensions.”

With inflation expected to be well contained, the BSP said a “more accommodative monetary policy stance remains warranted.”

“Emerging risks to inflation from rising geopolitical tensions and external policy uncertainty will require closer monitoring, alongside the continued assessment of the impact of prior monetary policy adjustments,” it said.

Analysts expect inflation to remain within target for the remainder of the year.

“Although we could see an upward trend in inflation going forward due to base effects, we still expect monthly inflation prints to remain below the BSP’s 2-4% target for the rest of the year,” Chinabank Research said in a commentary.

Rice inflation is seen to remain negative for the year due to base effects and continued decline in monthly rice prices, it added.

“However, the impact of favorable base effects may begin to fade by September and inflation could move closer to 3% by yearend,” Bank of the Philippine Islands Lead Economist Emilio S. Neri, Jr. said.

Chinabank said upside risks include adverse weather and the proposals to raise the rice tariff rate and limit rice imports.

“A severe storm affecting agricultural output could lead to faster inflation. Global oil prices may remain stable due to the expected increase in oil supply, but any renewed conflict in the Middle East could trigger a spike,” Mr. Neri said.

RATE CUTS

However, with inflation well below the 2-4% target band, the central bank has more than enough room to deliver more rate cuts, analysts said.

“This benign inflation outlook bodes well for domestic consumption activities, and it supports the case for further monetary easing from the BSP,” Chinabank said.

Mr. Neri said the moderating inflation and dovish signals from the BSP make a rate cut in August “highly probable.”

For its part, Chinabank expects another 25-bp reduction at the Monetary Board’s meeting later this month and another cut in the fourth quarter.

“A downside surprise in gross domestic product (GDP) on Thursday would likely cement the case for a cut,” Mr. Neri said.

The PSA is set to release second-quarter GDP on Aug. 7 (Thursday).

The Philippine economy likely grew 5.5% in the second quarter, according to a median forecast of 17 analysts. If realized, this would be slower than the 6.5% expansion in the year ago period.

“A September Fed rate cut could pave the way for the BSP to follow with another cut in October,” Mr. Neri said.

The Federal Open Market Committee’s next meeting is scheduled for Sept. 16 to 17.

“Nevertheless, uncertainties continue to cloud the outlook for US monetary policy. Tariffs may not have been fully passed on to US consumers, and a pickup in US inflation could delay Fed easing.”

“In this scenario, the room for another BSP rate cut could narrow. As such, caution is still warranted and it might be too early to fully price in a BSP rate cut in October,” Mr. Neri added.

Source: Business World