- Ziggurat Realestatecorp

- Sep 13, 2025

- 3 min read

Chief executives in the Philippines remain optimistic about industry prospects and are ramping up investments in people and technology to drive growth, a recently conducted survey showed.

“CEOs in the Philippines see both the risks and opportunities that lie ahead, such as the rising digital economy, sustained consumer spending, robust banking system and lower inflation and interest rates, among others,” PwC Philippines Chairman Roderick Danao said in a statement accompanying the release of the 2025 CEO Survey.

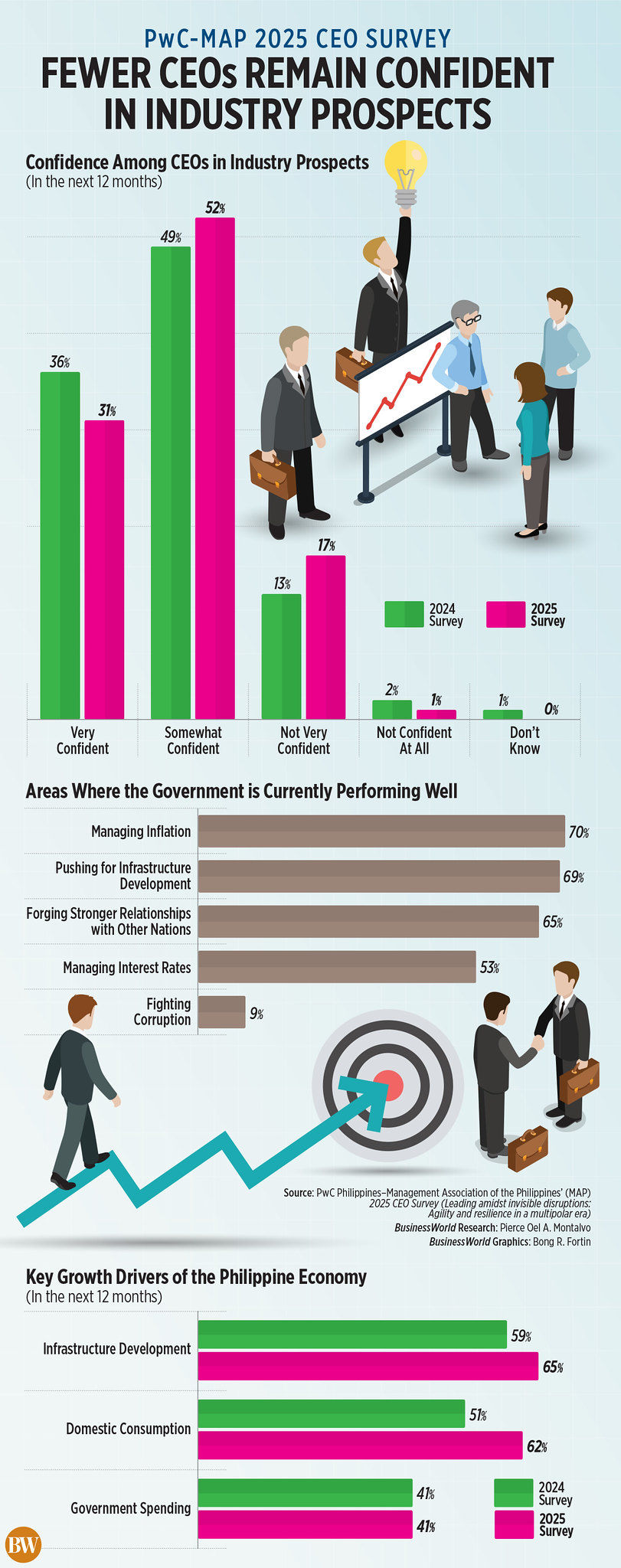

Optimism for the next 12 months was said to be strong, with 83 percent of survey respondents confident about the outlook for their industries and 84 percent expecting revenue growth.

The upbeat sentiment was said to be due to the country’s solid macroeconomic fundamentals, including within-target inflation and a robust monetary policy and banking system, sustained consumer spending, lending growth and higher liquidity.

However, more than half of the CEOs (52 percent) raised fears that their companies would no longer be viable after 10 years if changes were not made. Inflation was tagged as a key risk by 94 percent, followed by macroeconomic volatility (93 percent).

Cyber risks are another major concern and were cited by 84 percent of the respondents.

Adapting to change

CEOs were said to be aware of the headwinds with digital transformation particularly high on the agenda: 68 percent said they had integrated artificial intelligence (AI) into strategies and plans and 60 percent claimed implementation had started.

Respondents also had high expectations for generative AI, with 89 percent saying it would improve products and services, and most noted the need to upskill workers to extend business viability.

Eighty-two percent said they were focused on upskilling, 78 percent said they were pushing forward with automation initiatives, and 63 percent claimed to be using advanced technologies.

Sixty-two percent said talent retention and skill shortages were their top concerns, while 51 percent pointed to resource constraints.

Forty-seven percent, meanwhile, tagged the pull between short-term pressures and long-term goals.

As part of adaptation measures, companies were said to be revamping their decision-making processes, with 45 percent claiming shorter timelines and more frequent reviews.

Consultations are also being expanded, with 64 percent drawing on diverse executive perspectives and 62 percent seeking outside views.

‘More agile’

“This year’s survey shows that leaders are being more agile to ensure better service, shorter lead times and sustained outcomes,” PwC Philippines partner Trissy Rogacion said in the statement.

“By accelerating decision-making processes and streamlining workflows, organizations are not only enhancing the customer experience but also maintaining the momentum needed for long-term growth and resilience.” This year’s survey, which was answered by nearly 200 CEOs, was conducted from July 22 to Aug. 25, 2025, with the majority of respondents being members of the Management Association of the Philippines.

Other findings of the poll were that infrastructure development (65 percent) and domestic consumption (62 percent) would be the primary drivers of economic growth over the next 12 months and that the government was doing well in terms of pushing for infrastructure (69 percent).

The state also scored high in terms of foreign relations (65 percent), managing inflation (70 percent) and managing interest rates (53 percent), but just 9 percent of the respondents said it was doing well against corruption.

A quarter (25 percent) expect global economic growth to slightly decline over the next 12 months while just 20 percent said their business was facing threats from US tariffs.

Thirty-five percent said they would be revisiting plans to enter a new industry in the year ahead, 28 percent said they would expand outside the Philippines, and 17 percent would consider selling a stake in existing businesses.

Source: Manila Times