- Ziggurat Realestatecorp

- Jun 30

- 2 min read

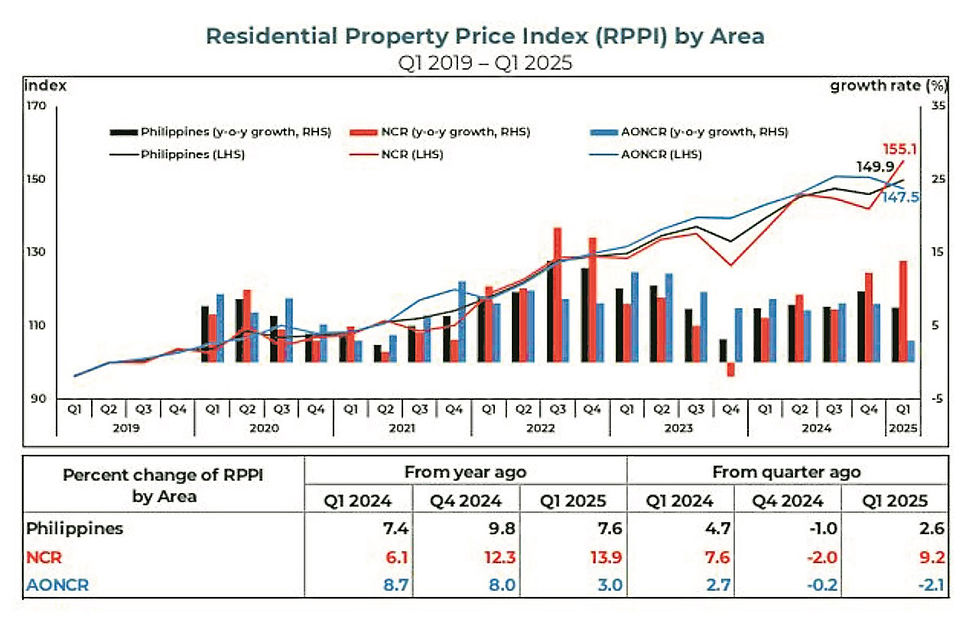

Residential property prices in the Philippines continued to increase, although at a slower pace, during the first quarter of 2025 (Q1 2025), the Bangko Sentral ng Pilipinas (BSP) reported.

Year-on-year growth of the Residential Property Price Index (RPPI) slowed to 7.6 percent in January-March from 9.8 percent in the last three months of 2024. On a quarter-on-quarter basis, prices reversed from the fourth quarter of last year’s 1.0-percent drop, growing by 2.6 percent.

The National Capital Region (NCR) led residential property price growth with a 13.9-percent increase, significantly higher than the 3.0 percent observed in the rest of the country. Quarter on quarter, the NCR saw a 9.2-percent expansion while areas outside it recorded a 2.1-percent drop.

All areas outside the NCR, with the exception of Metro Cebu, recorded higher prices. Houses in Mindanao became 7.6-percent pricer, followed by the rest of the Greater Manila Area (GMA) at 3.8 percent and other areas in the Philippines at 1.1 percent.

Metro Cebu, on the other hand, registered a 1.7-percent drop — its first annual decrease since the first quarter of 2023.

All housing categories contributed to the higher prices, with condominiums and houses recording growth rates of 10.6 percent and 4.5 percent, respectively. Houses measured include single-attached, detached, town houses, duplexes and apartments.

Quarter on quarter, condominium prices grew by 9.9 percent, offsetting a 2.9-percent drop for houses.

The median price for all housing types was P3.37 million, the BSP said, lower than the P4.34 million for condominiums but above the P2.95 million for houses.

Houses in the NCR were the most expensive with a median price of P7.7 million, while condominiums in other areas in the Philippines were the cheapest at P2.5 million.

Residential real estate loans taken out during the first quarter, meanwhile, were mostly used to purchase new housing units (73.2 percent), with the remaining 26.4 percent and 0.5 percent used to buy pre-owned and foreclosed properties.

By type of housing, 63.7 percent of the loans were used for houses and the rest for condominiums.

Just over a fourth, or 27.4 percent, of the property loans were granted in the NCR. Calabarzon (Cavite, Laguna, Batangas, Rizal and Quezon) accounted for 29.9 percent; Central Luzon, 13.8 percent, Central Visayas, 9.6 percent; Western Visayas, 7.9 percent; Davao, 4.5 percent; and Northern Mindanao (2.5 percent).

The NCR and these six regions accounted for 95.6 percent of housing loans granted by banks, the BSP said.

The RPPI calculates the average change in prices of different kinds of housing units over time from bank data on loans made to purchase residential properties.

The quarterly index, beginning the first quarter of 2025, now uses a different methodology to align with international best practices and has been renamed from the Residential Real Estate Price Index. Among others, it now uses acquisition cost instead of appraised value, and the property type has been expanded to include pre-owned and foreclosed units instead of just new ones.

Instead of just the NCR and areas outside it, the latter has further been divided into balance GMA, Metro Cebu, Metro Mindanao and other areas in the Philippines.

Source: Manila Times