- Ziggurat Realestatecorp

- Sep 19, 2025

- 3 min read

There are no easy solutions to ease the housing affordability crisis, and some may run counter to President Trump’s other goals.

The ballooning costs of buying a home have put homeownership out of reach for many Americans for quite some time, and last week the White House weighed in. “We may declare a national housing emergency in the fall,” Treasury Secretary Scott Bessent told the Washington Examiner in a Labor Day interview, but he provided scant detail beyond suggesting that the administration is looking at ways to standardize building codes and trim closing costs.

Some experts are concerned that such an emergency declaration would amount to an empty gesture. Although an affordability crisis is undoubtedly ongoing, there are no simple solutions, and many steps that could address the issue run counter to President Donald Trump’s other goals. “There are no shortcuts to answering this problem, because it took a long time to create,” says Andrew Wells, chief investment officer of investment management firm SanJac Alpha. “Either mortgage rates have to come down, or the cost of things associated with homeownership like insurance have to come down.” Of course, there is no guarantee that any patches are in the works.

Moreover, it “remains unclear exactly what kind of emergency measures the administration could take to address housing, or even if using emergency powers in this way is lawful,” notes Realtor.com senior economist Joel Berner. Assuming a declaration is issued, there are practical limitations on what the White House could do to address long-term affordability issues. Some of the president’s keystone policies, like tariffs and mass deportations, are contributing to housing costs, given increasing prices for things like lumber, steel, and labor. Although most of the market is focused on interest-rate cuts that Trump has demanded, which may come as early as this month, they won’t necessarily bring down mortgage rates.

After the last round of rate cuts in 2024, mortgage rates actually finished the year higher, as they (and long-dated Treasuries) take into account other data, including inflation and economic expectations. Likewise, Wells warns that if the government offers a tax rebate or subsidy, that only goes so far in helping Americans buy an “unaffordable asset, and you’re back to printing checks again,” like the pandemic-era stimulus checks that contributed to inflation and higher housing prices.

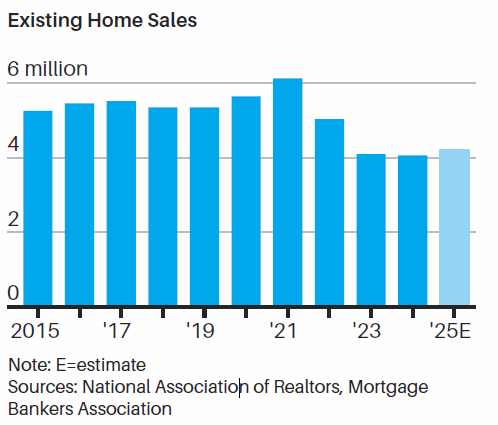

The housing bubble and subprime mortgage crisis helped kick off the 2008-09 global financial crisis, so there was a reluctance to build homes in the aftermath. However, some 20 million households have been formed since, and only 18 million homes have been built. There are some actions the president could try to increase supply, but these are likely to be met with resistance.

“Overriding, or at least standardizing, local laws on zoning would be a great step toward allowing builders to deliver the inventory needed,” says Berner. “Streamlining the permitting process and putting fewer restrictions on builders would be a great way to augment home inventory.”

That probably would boost builder stocks. The iShares US Home Construction exchange-traded fund is slightly trailing the S&P 500 index this year, although some builders, like D.R. Horton and PulteGroup, have surged more than 25%. Others, like Lennar and NVR, have lagged behind peers. Buddy Hughes, chairman of the National Association of Homebuilders trade group, also hopes deregulation will be part of any executive action, arguing for a “secure and affordable supply chain of building materials, and enacting policies that address a lack of skilled labor in construction.

A proactive agenda to bring down material, construction, and labor costs will also help.” The problem is that many high demand areas, like the Northeast, are likely to want to keep their local regulations for safety and environmental reasons—and blue states are more likely to challenge changes in court. Still, any well-reasoned action would be better than nothing.

According to the builders’ trade group, 75% of American households can’t afford a median-price new home. That means there could be ample public support to smooth the way for any popular policies that ease this crisis. Yet any lasting solution will necessarily be multipronged and take time to implement. No matter what happens, it seems as if the current house of cards can’t stand much longer

Source: Barrons